Stripe for the Agentic Web

We provide developers with a simple API that lets agents pay and get paid easily. Behind it is the fastest, cheapest, and currency-agnostic payment network, purpose-built for nano-transactions on the Agentic Web.

Problem: Agents and AI services can’t transact reliably—credit cards are too expensive, blockchains too slow, and existing wallets too complex.

Solution: Grindery is Stripe for the Agentic Web—a simple API that lets developers enable agents to pay and get paid instantly.

Why Us: We’ve built the fastest, cheapest, currency-agnostic payment network designed for nano-transactions, safe for both people and agents.

Overview

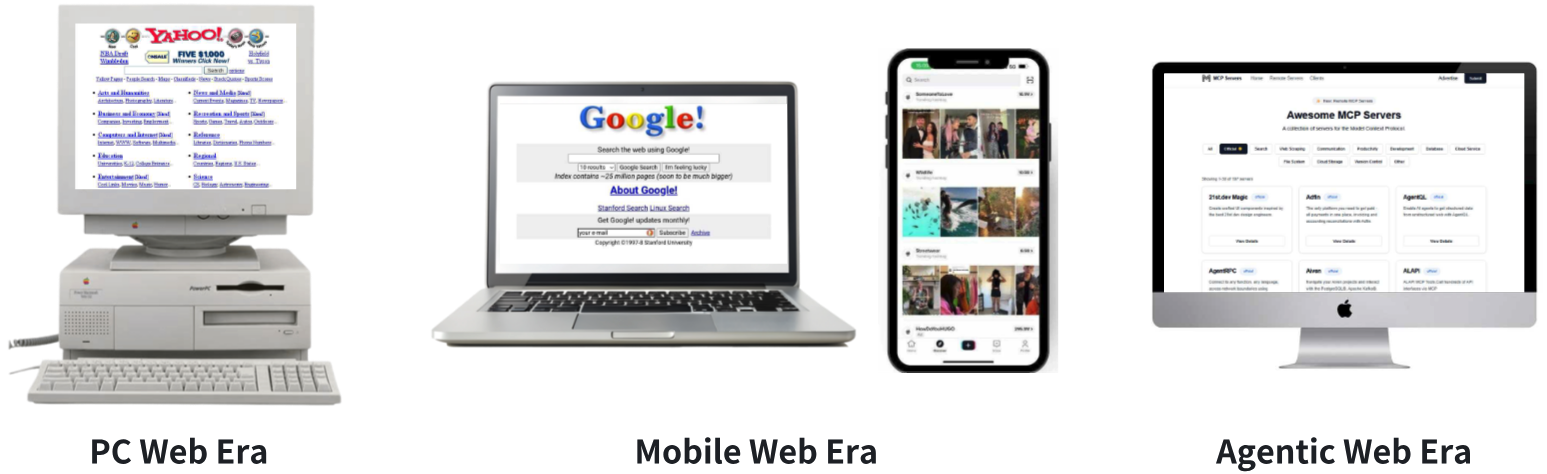

The Agentic Web is the next stage of the internet: instead of humans clicking through interfaces, autonomous agents will carry out tasks on our behalf. These agents will plan, negotiate, and transact with other agents, unlocking entirely new ways for software to work for us. The shift is already underway, as major technology companies adopt agent frameworks and research increasingly shows how multi-agent systems can transform everything from enterprise automation to consumer services.

But to make the Agentic Web real, a host of challenges need to be solved. Agents must discover and trust one another, interoperate across open protocols, and stay safe under human oversight. They need ways to share context, attribute actions, and prove accountability. And critically, they must be able to exchange value reliably and at scale — because without payments, there is no economy to sustain their work.

This is where today's infrastructure falls short. Fiat payment systems, especially credit cards, are completely unsuited to agent-scale activity. They are too slow — settlement takes days, not milliseconds. They are too expensive — a fixed fee of $0.20 to $0.30 per transaction makes it impossible to pay for a $0.002 service call. And they are optimized for large, infrequent human purchases, not the rapid-fire, machine-to-machine interactions the Agentic Web depends on.

Recognizing this gap, many blockchain protocols and wallet solutions have emerged with the goal of enabling micropayments. Yet they stumble on the same hurdles. Settlement-first models force every transaction to wait for block confirmation, adding seconds of latency where only milliseconds are tolerable. Even "cheap" networks charge fees larger than the value of most agent calls, breaking the economics. Channel-based systems require capital to be locked up and pre-negotiated, which doesn't work in a world where agents constantly interact with new providers. And approaches like probabilistic or streaming payments fit narrow use cases but fail for the heterogeneous, disputable tasks agents actually perform.

What is needed is a new kind of wallet — one designed specifically for the Agentic Web. Its vision is clear: enable agents to transact at machine speed, with costs that shrink to near zero as usage scales, while giving users confidence that charges are controlled and reversible, and providers certainty that valid payments will be honored. To people and businesses, it should feel as seamless as today's toll systems or credit cards, integrating smoothly with existing billing and accounting processes. To agents, it should be invisible — a background layer that makes every micro-interaction economically viable.

Where Existing Approaches Fall Short

Arc (Circle) and Tempo (Stripe) promise to finally solve blockchain's settlement problems when they launch in 2025. Arc delivers sub-second finality with USDC as native gas token, targeting 3,000-10,000 TPS using Malachite consensus. Tempo pushes further—100,000+ TPS with an enshrined AMM that lets any stablecoin pay gas fees, built on Reth for EVM compatibility. Google's Universal Ledger (GCUL) follows with Python smart contracts and institutional-grade infrastructure. These aren't general-purpose VMs doing payments on the side—they're purpose-built settlement layers with payment-specific opcodes and dedicated transaction lanes.

A Decade of Innovation Got Us Here

The blockchain industry has spent years iterating toward the perfect payment rail, each attempt revealing critical constraints:

On-chain settlement (2015-present) pioneered atomic, trustless payments but hit fundamental limits. Even optimized chains like Solana (400ms block times, $0.00025 fees) or Polygon (<2s, $0.01) require global consensus for every transaction. When agents make 1000 calls/minute, those milliseconds and fractions of cents compound into seconds of latency and dollars in fees.

State channels (Lightning 2018, Raiden 2020) solved the latency problem through off-chain transactions with on-chain settlement. But they require pre-funded channels between counterparties—impossible when agents dynamically discover and call new services. The capital lockup alone (billions needed for global agent liquidity) makes this unviable for the permissionless agent economy.

Payment channel networks tried to fix this with HTLC routing and liquidity pools, but path-finding becomes O(n²) complex at scale. Worse, they lose transaction atomicity—if hop 3 of 5 fails, unwinding is complex. The routing problem alone consumed years of Lightning development just to enable pizza purchases.

ERC-20 permits (EIP-2612, 2020) brought gasless transactions via signature-based approvals. But they're binary—either unlimited approval (security nightmare) or per-transaction signatures (latency nightmare). No native support for spending scopes like "max $10/day for API calls" or attribution tracking through delegation chains.

Probabilistic micropayments (Orchid 2019, Livepeer 2018) brilliantly reduced on-chain footprint by settling randomly—send a 1% chance of $1 instead of $0.01. Perfect for homogeneous streams, but agents need deterministic payment for each unique task. You can't probabilistically pay for a specific inference result.

Native AI tokens (AGIX/ASI, FET, OLAS) built complete agent economies with native utility tokens. But they added FX risk to every transaction—your API costs fluctuate with token price. The cognitive overhead of managing treasury volatility killed adoption outside crypto-native teams.

x402 (Coinbase 2024) elegantly embedded payments in HTTP using the dormant 402 status code. One line of middleware, payments in headers, chain-agnostic design. But it still inherits the underlying settlement model—every HTTP request triggers an on-chain transaction. Beautiful protocol, wrong economic model.

Nevermined (2024) got closest to solving the agent billing problem with payment plans, credits, and MCP integration. Agents can buy credits upfront and spend them on API calls without per-transaction settlement. But it's a closed system—credits are provider-specific, don't compose across services, and still inherit the underlying chain's settlement latency when moving between providers. It solves billing within a silo, not across the open agent economy.

The Real Problem They Leave Unsolved

Arc, Tempo, and GCUL will deliver sub-cent, sub-second settlement. But they're still settlement layers, not billing systems.

Agents need programmatic spending controls—not just "wallet has X balance" but "spend max Y per call, Z per day, only on services matching pattern W." They need attribution through delegation chains—when AgentA delegates to AgentB which calls AgentC, the costs must trace back. They need dispute resolution that doesn't require smart contract arbitration for every $0.001 charge.

Most critically, they need economic abstraction. Even at Tempo's theoretical $0.0001 per transaction, 1000 API calls still cost $0.10 in fees for $0.10 in compute value—100% overhead. The unit economics break.

Bottom line: Settlement infrastructure has improved 1000x. But agents don't need better settlement—they need to avoid settlement entirely for micro-transactions. Credit-before-settlement isn't an optimization, it's an existential requirement for the agent economy.

Grindery Wallet: A New Approach

Grindery Wallet is built from the ground up for the Agentic Web. At its heart, the idea is simple: create digital wallets with native support for credit-card style, zero-latency, low-cost nano-transactions.

When an agent wants to act, it shouldn't need to wait for money to move on-chain or through a bank. Instead, the wallet checks in real time whether the agent has a valid credit scope or balance, logs the intent to charge, and lets the task run instantly. The actual movement of funds happens later, in large batches, once the dust has settled and users have had the chance to dispute or reject invalid charges.

This is the same principle that makes credit cards and electronic toll systems work in the physical world. You tap, you go — the clearing and reconciliation happen afterwards. Grindery Wallet brings that model to the digital economy, but tuned for the scale and precision the Agentic Web demands.

How It Works

Scoped Credit: Each Grindery Wallet comes with built-in credit management. Users pre-fund a small balance or extend a limited credit line. They authorize agents with spending scopes — caps, rate limits, purposes, and expiry. This ensures autonomy is bounded and revocable.

Instant Authorization: When a charge request comes in, the wallet checks authorization records cached in memory in milliseconds. If valid, the service executes immediately. No waiting for blockchain confirmation.

Tamper-Evident Logging: Each charge is recorded in the wallet's append-only ledger. It binds the principal, the provider, the task ID, and the metering evidence, so charges can always be attributed and audited.

Dispute Window: Users have a set period to reject unwanted charges through their wallet interface. This provides the same safety net as chargebacks, but in a lightweight and programmable way.

Batch Settlement: Accepted charges are netted and settled together on-chain. Instead of thousands of blockchain transactions, one settlement moves all funds, driving per-call costs effectively to zero.

Native Wallet Features

Unlike traditional wallets that just hold keys and sign transactions, Grindery Wallets have billing intelligence built in:

Credit Limits: Set spending caps per agent, per day, or per task type — just like credit card limits but programmable.

Spending Scopes: Define what agents can spend on, when, and with whom. Scopes cascade through agent chains while maintaining attribution.

Usage Analytics: Built-in dashboards show spending patterns, agent activity, and cost breakdowns — no external tools needed.

Dispute Management: Review and reject charges directly in the wallet UI, with automatic reconciliation.

Multi-Currency Support: While optimized for USDC, wallets can hold and transact in any supported token, with automatic conversion at point of sale.

Solving the Core Problems

With this integrated design, Grindery Wallet directly addresses the hardest problems of the Agentic Web:

Cost of Micro-Transactions

Because all charges are logged locally and only settled in batches on-chain, the cost per individual call approaches zero. A thousand agent-to-agent calls can be cleared with the same single settlement fee. This finally makes sub-cent interactions economically viable.

Latency at Scale

Authorization is handled by the wallet's local credit check that takes milliseconds. An agent chain with ten or even a hundred steps runs without noticeable delay, because none of the calls wait for on-chain settlement.

Cascading Billing and Attribution

Every charge carries the principal, the task ID, and the agent scope that triggered it. The wallet maintains the full attribution chain. Even if an agent delegates work to another agent, which delegates again, the costs remain traceable back to the original user.

Non-Crypto World Compatibility

With account abstraction built in, users don't need to manage keys, seed phrases, or gas tokens. They can top up balances in familiar ways — via card, bank transfer, or stable payment rails — while the wallet handles everything behind the scenes. To the end user, it feels like a normal payment app.

Ease of Integration

For developers, Grindery Wallet provides a simple API — like Stripe for agents. Instead of managing wallets, gas, and settlements, they just make API calls to charge users. The wallet handles authorization, scope enforcement, disputes, and settlement automatically.

Implementation

Grindery Wallets integrate smoothly with existing billing systems — whether it's a simple paywall service or a SaaS provider's metering and invoicing stack. This should be as simple as making an API call: log a usage event, generate a charge entry, and let the wallet handle the rest. Developers don't build settlement logic, dispute handling, or multi-hop attribution — those come built into every Grindery Wallet.

Every user and agent gets a smart wallet to authorize charges and enforce limits. This doesn't feel like "crypto." Grindery's account abstraction stack makes it possible to provision wallets without seed phrases, let users top up with a card or bank account, and enforce spending scopes invisibly in the background. To the end user, it feels like loading a prepaid balance in a regular app; to the agent ecosystem, it provides a programmable wallet with native billing capabilities.

The wallet's settlement layer operates across low-cost L1s and L2s that already support stablecoins. Viable venues include Polygon (PoS and zkEVM), Arbitrum One or Nova, Base (Coinbase's L2), zkSync Era, BNB Chain / opBNB, and Optimism. Each offers cheap, high-throughput settlement and mature EVM compatibility. Beyond the EVM world, Solana stands out as a high-throughput USDC rail, already tapped by Visa pilots. Stellar and Celo (now an Ethereum L2) have long focused on remittances and payments, while XRP Ledger positions itself for cross-border bank rails.

All of these will come under pressure from Circle's Arc, Stripe's Tempo networks, and Google's recently announced Universal Ledger, which aim to make USDC and digital asset payments issuer-native. Grindery Wallets plug directly into those ecosystems, since the wallet is settlement-agnostic — it just needs a low-cost chain where USDC is native. The wallet intelligently routes settlements to the most efficient chain based on cost and speed.

Over time, Grindery could also deploy its own chain — either as a specialized L2 (like a validity rollup) or as an L3 sitting on top of a popular L2. Running as a dedicated layer brings two advantages: first, predictable ultra-low fees, since economics can be tuned for microtransactions rather than generalized DeFi traffic; and second, native billing opcodes, meaning batching, disputes, and attribution can be system calls instead of contracts. This reduces complexity for developers and guarantees performance at scale. Think of it as the "Stripe network" for agents, where the whole chain is optimized for credit-before-settlement billing.

The benefit of this flexible deployment strategy is twofold. In the near term, Grindery Wallets can ride existing chains and their liquidity — whether that's Polygon, Arbitrum Nova, or Base — to get adoption quickly. In the longer run, it can harden into its own app-chain or supernet/subnet (on Polygon Supernets, Avalanche Subnets, or Optimism's OP Stack), ensuring costs stay near zero even as agentic traffic grows to millions of transactions per second. That way, it doesn't just survive the coming wave of USDC-native payment rails from Circle, Stripe, and Google, but actually complements them by providing the missing billing intelligence that those raw networks lack.

Cross-Chain by Design

Grindery Wallets aren't tied to a single chain. They can hold balances and settle on any supported network: Polygon for low costs, Arbitrum for Ethereum compatibility, Base for Coinbase integration, or Solana for maximum throughput. The wallet abstracts away chain selection, automatically choosing the most efficient rail for each settlement batch.

This positions Grindery Wallets to work seamlessly with emerging USDC-native networks from Circle (Arc) and Stripe (Tempo). As these networks mature, Grindery Wallets will provide the missing billing intelligence layer they lack — the spending controls, attribution tracking, and dispute management that make agent economies possible.

Conclusion

The Agentic Web needs more than just another payment protocol or wallet solution. It needs wallets built specifically for how agents transact: millions of micro-interactions, instant authorization, traceable attribution, and user control.

Grindery Wallet provides exactly that. It's not a protocol you implement or infrastructure you deploy. It's a wallet your users already understand, with an API your developers can integrate in minutes. The credit-card style billing model is native to the wallet itself, not bolted on afterwards.

By combining smart wallets, credit management, and batch settlement into one seamless product, Grindery Wallet becomes the payment infrastructure for the Agentic Web — as fundamental as HTTP was for the Web itself. Simple for users, trivial for developers, and invisible to agents.

How it works (1)How it works